👆🏼 You can listen here 🎧

⏳ Current status

📧 Email subscribers: 43.513 / 100.000

👥 Active users: 1.478

🎞 New Mini Documentary: Interview with Hormozi - Final Touches

⏰ Time to write: 8 hours 28 minutes

In 19 minutes, I will teach you the knowledge that school could NOT teach you in 12 years. ❌

I've gotten the "How to deal with money" question at least 100x, so I thought it was time to teach you this through a Blog post.

I'll show you specifically:

What I spend in a month. 💸

How do you allocate your money? 🧐

How do you track your spending? 😨

And, what the heck is a Wish farm?! 🤨

With this knowledge you're guaranteed to be ahead of 98% of people.

But before we dive into the mysterious world of finance, let's see... 🏊🏼♂️

🚀 How's the challenge?

🤩 We have the speakers for 10 December

Our next offline event will take place at the University of Óbuda, called Mindset Meetup. The whole point is to bring like-minded young people together and make new connections easily. 🤝

But we don't stop there!

There will also be 2 presentations by eminent professionals:

🤯 How to prevent burnout - with Fuller Bio

💰 How to finance your start-up - Patrícia Tarczali (from Future Proof Consulting), Kirill Perepelica (from Munch), Gábor Kövesdi (from Brancs), and of course myself, so that OM is represented.

If that didn't get you in the mood for the event, I don't know what will. 😉

i.e., I don't know when you'll see this, but if you're lucky you can still hunt down tickets for yourself here: https://conf-00804.ticketninja.io/

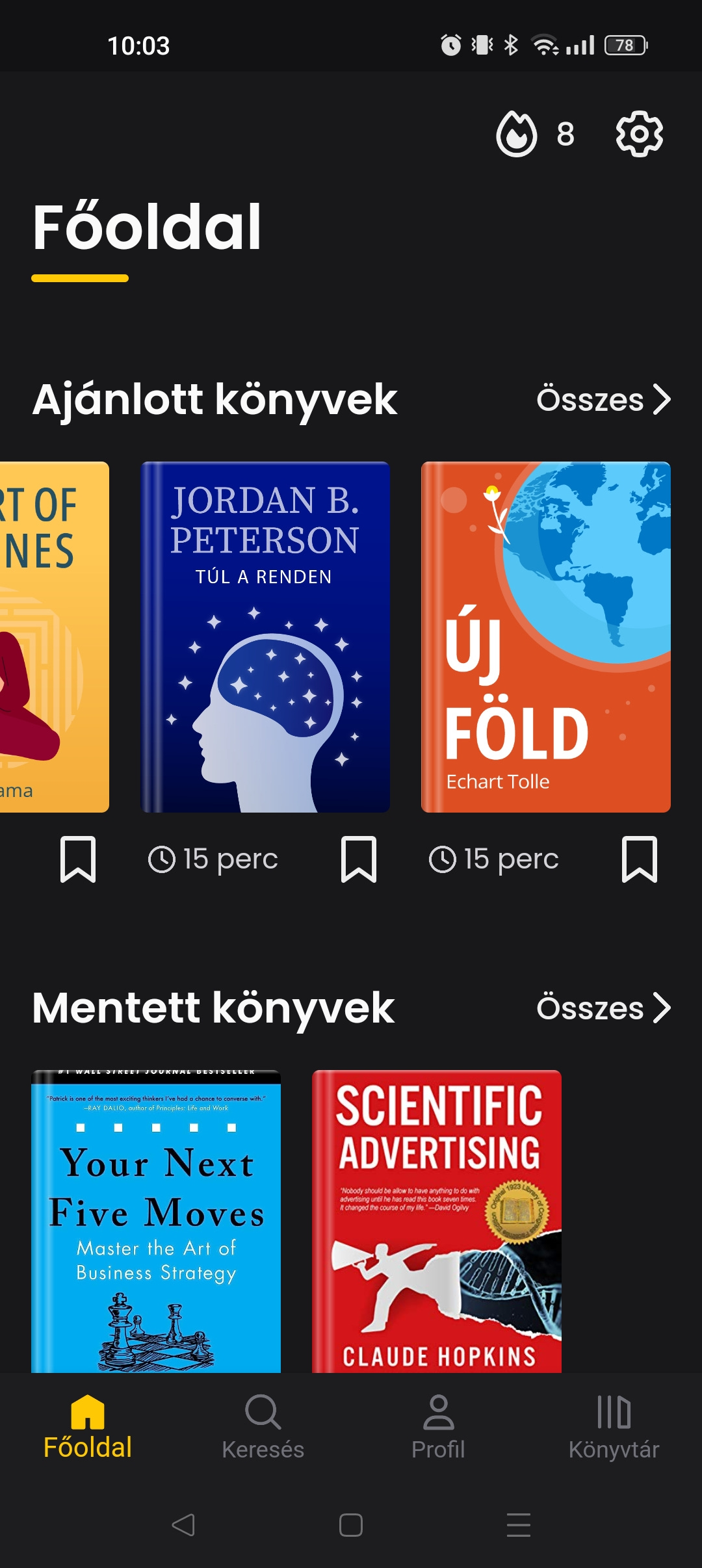

🎨 A little teaser for the New App

What you'll see here is already in code and will look exactly the same in the App.

The guys put a lot of work into it to make it so clean and fast. It takes 0.8 seconds to load on Edu's phone. Which is pretty rough compared to the 8.5 seconds it used to take. ⚡️

The Recommended books are there for a reason, as AI recommendation is finally included in the App. ✨

The Covers have a full 3D effect, so you really feel like you're reading a book. Small thing, but psychologically it adds a lot. 🧠

True, you've only seen one screen of the whole App. But I'm curious to know what you think of it, feel free to post it on Instagram or hit vote here. ✏️

Okay, let's get started... 🪓

💭 Why is it important to keep track of your money?

Dozens of books on 'financial awareness' are published every year. It's a magic word, but it's still a bit confusing. 📚

Let's look at what financial awareness means according to the literature.

Meaning: financial awareness is a way of looking at things that helps us to see our options clearly after an honest and detailed exploration of our financial situation.

Hooray, we didn't learn any of that... 👏

I'll try to explain it in my own words, I think we'll be ahead of the game.

Meaning: Financial awareness means being aware of your income and expenditure, budgeting it and therefore being prepared for unexpected situations or opportunities.

Ergo, we don't throw our money around, we budget it. ✅

Let me give you a simple example to help you understand the importance of this.

I think you've heard of the American Football League - the NFL. If not, you are not missing anything, it is a sport that is loved in America and has a huge reputation 🏈(that's all you need to know)

The average NFL player has a career that lasts 7 years. You have to be physically on top of your game.

However, during those 7 years they make about $3,200,000.

That's 1.100.000.000 HUF. 🤑

Of course, living in the United States is more expensive, but it is safe to say that you could live comfortably in retirement on that kind of money. 🌎

But the sad truth is...

"78% of NFL players, 2 years into their careers, find themselves in a very difficult financial situation."

Source: article from Sports Illustrated

So nearly 8 out of 10 players blow their money. 😰

And by the time they get to the point where their career is over, they have nothing left.

You wouldn't believe it, but it's the same with lottery winners. 🍀

"Nearly 1/3 of lottery winners go completely bankrupt over time."

Source: CFPBS Consumer Financial Protection Bureau

But we don't stop there... 😱

This data will really shock you:

"70% of lottery winners will be worse off financially within 5 years than before they won the lottery."

Source: The Guardian

Of course, you - the one reading this - will find these figures shocking, because you're coming from your own mindset and you know that YOU would have certainly been better off. 🙏🏻

The problem is that these lottery winners don't have that kind of mindset.

Quite simply, they do NOT know how to budget their money! ❌

However, this post was written precisely to stop you falling into this trap.

If you follow the "How to" section, I guarantee you will be more financially aware than 98% of people! 💰

But before we get started, an interesting fact...

Did you know that: For every person you send the Blog to who subscribes, you will receive gifts! And quite valuable ones at that:

1️⃣ Invited - 🧭 Guideline Targeting Ebook

3️⃣ invited - 📙 Exclusive Workbook with Practical Tasks (with the most useful books I've read)

🔟 Invited - 🎥 Self Confidence Course with 11 videos (showing you specifically how to be more confident in business, meeting people and making friends)

Thank you! 🧡

Use this button to send it to them.

🧐 How to save your money?

Get ready, because this part is going to be fully practical. 😎

I'll show you the path I took to experiment this easy and semi-automatic system that I still use today. 🧪

I first read about it in "Secrets of the Millionaire Mind", what financial awareness is and how I need to budget my money. She talked about envelopes and pockets.

It was a bit of a mess.

I remember I had a hard time finishing that book because I didn't fully understand it. And I suddenly didn't apply what I'd learned there.

And then a month or two later, it started nagging at me that it would still be fun to do this, but not quite the way the book said. 🤔

So, I used my creativity and started searching online. Lo and behold there were loads of these App.

I even downloaded a Hungarian developed app that was free to use - it was called Koin and later that's what it lost - it couldn't make money. 📲

I spent about 1 year on Koin before it shut down.

It helped a lot to at least develop this activity as a habit. ✅

It's important to note that there was no schedule here, I just wrote down what I was spending and at the end of the month I was happy or surprised to see how much money I had left.

That was level 1!

After they went bankrupt, I had to find a new solution. 🧐

I was like, if I'm going to switch, I want to switch to the best! 🔥

I spent nearly 30 hours researching before I found this one:

I had read so many good things about YNAB (You Need A Budget) that I had to try it out.

It's been 3 years now and I'm still a proud user. ✅

There is one fundamental difference between YNAB and Koin:

While in Koin, I wrote my spending and watched the amount of my spending increase.

In the meantime, I have to determine in YNAB at the beginning of the month approximately how much I will spend that month on that particular category. That way, as I add up my spending, the amount I can use is TOTAL. So I can see specifically how much more I can spend.

💡 Side note: This exploits a psychological factor that our brains don't like to go minus in any area, so they do their best to make sure that doesn't happen. This little trick saved me 180,000 in the first year!

But enough theory, let's see how it all works...

🎥 If you want to watch it as a video, you can do that for a change:

💡 Side note: I'm specifically building a sample wallet here and you can see when and where I click. So much so that this is 1 year old video and I may go through the steps in a different order, but the end result is the same. Plus, here I show you the hardcore features like "recurring spending" or "goals to achieve".

Step 1 - Download the YNAB App 📲

Yes, I know, it's paid, but if you're a student, it's free for a year just email them on Chat and send them your student ID. 👦🏼

If you're not a student, it's still free for 34 days and after that it's about 5.000 HUF per month.

Remember, if you do it smart, it will save you a lot more money than that 5,000 HUF a month. 😉

Step 2 - Calculate how much money you have 💰

⚠️ Important: Here we don't transfer anything, we just write down how much money we have! The app is not linked to any bank account, so it has no access to your money. It only works based on what you manually write down.

This is necessary because it tells us how much money we have in total and how much we can allocate.

You can add accounts manually on the page under "All Accounts". It's best to add your money as you have it. 🔍

See I do:

💸 Cash

💳 Savings account (with a negligible amount)

💳 Private account

📲 Revolut

🏦 and Euros Revolut (which also doesn't have much)

Setting up bank accounts is easy, you just log into your bank, check how much money you have in your account and manually enter it into YNAB, cash sucks because you have to count it once. 🧮

Once you do that, you can see how much money you have in total, at least in one. Which is good news, because the average person often doesn't even know that. ✅

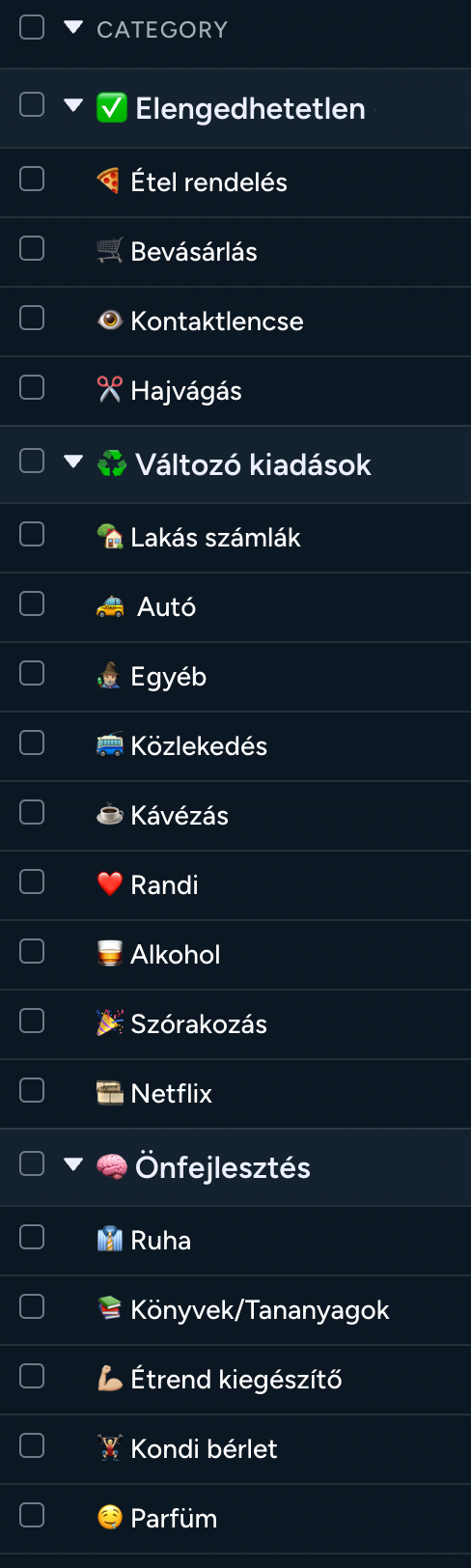

Step 3 - I divide my spending into categories 🤔

Think of it as a big sum, now start dividing it into small pockets.

Only first we need to figure out what we want to allocate it to. 📝

The distribution will look like this:

Main category

Subcategory 1

Subcategory 2

Subcategory 3

For me, the main categories look like this:

I will explain the Wish farm and the safety reserve later. 🔒

The next step is to add subcategories to fully customize it. After all, someone will write Artificial Eyelashes here and someone will write Tennis Pass. 🎾

💡 Side note: You don't need to add each expenditure as a separate subcategory, but combine them where possible. For example, for girls, Artificial Eyelashes, Cosmetics, Hairdresser could go into a Beauty Care subcategory under the main category of "Variable" - or for some, "Essential".

If it's complicated so far, rest assured, it's about to become clear. 🥵

Step 4 - Defining subcategories 🧐

This is specifically the step where you look at what you spend on and divide them into subcategories and put them under the above categories.

For example, I used to wear contact lenses, which was quite important, so I put this under the Essential main category as "Contact Lenses" because I knew I had to spend 12.000 HUF per month on it. 👁️

💡 Side note: I've since had eye surgery, but I've kept this subcategory and put eye drops and things like that in this one.

It's also the same place for things like eating out or shopping. But it's easiest to pull back the curtain and give you a full insight into how I spend. 🍕

Most of it is understandable, but I'll explain the ones that may seem complicated at first glance.

The reason I have separate "Food Ordering" and "Shopping" is because I used to order a lot of food on Foodora and tried to squeeze that down, so I bought it as a separate subcategory and put less money aside for it, month by month. 🛵

Alcohol and Entertainment are separated for the exact same reason, so I spend less on Alcohol. 🥃

Transport and Car are split up because, if I don't have to, I don't drive to work or read in between. 🚌

And Clothing is under Self Improvement because it contributes to my appearance, but I don't buy new clothes every month. 👔

And yes, you can see that Netflix is there too, but there's nothing to do, everything has to be written down here. (See I could have merged this with "Entertainment" for example, but that's when you learn)

If you look at the picture above then my subcategories may lead the way. But this is where you really need to personalize your own system, the video above will help with that. It's like a Tutorial! 👣

Step 5 - So, what is a Safety Reserve? 🔒

It's a category that you hopefully only need to top up with money once. And in the best case, you don't touch it.

Specifically, it's there to ensure that if something big catastrophic happens, you'll have that amount available. 🥵

It's best if you manage to build up a 6-month safety reserve.

But even 3 months is more than nothing. 😉

I'll show you how you can calculate how much money you need:

See how much you spend in a month, with everything.

For example: 300.000 Ft per month.

Then your 3 monthly safety margins would be: 900.000 Ft.

Because 3 x 300.000 Ft

And 6 months would be: 1.800.000 Ft

Because 6 x 300.000 Ft

This would mean that if you have 6 months of safety reserves and there is a redundancy at your job or you get sick or whatever, you could live at the same standard of living for 6 months as you do now. 😎

And 6 months is plenty of time to find a new job or a new vocation!

"Trouble happens when no one expects it."

That's why a safety margin is important. ✅

💡 Side note: Until you fill it up gradually, don't spend money on your investments and Wish farm. Because that's the priority!

Step 6 - Save money 💰

Now that you've got your subcategories and your safety margin, it's time to start allocating your money into these "pockets". 📂

If you have said 1.000.000 HUF.

Then first just enter how much you would spend this month.

For example:

Essential - Total 150.000 HUF

🍕 Food order - 57.000

🛒 Shopping - 75.000

👁️ Contact lenses - 12.000

✂️ Haircut - 6.000

This was just one Main category. Fill in the rest, but just for this month, how much you will realistically spend this month.

💡 Side note: If you have no idea, go back through your bank account history and add things up for the past month. If you're paying cash everywhere, give a rough estimate and write that in.

You'll see that as you fill up these "pockets" your total money to distribute above will decrease. ⬇️

In my case, this 196,000 does not mean that I have that much money, but that I have that much money that I have not yet pocketed.

So that's nothing to be scared of, you don't have less money, you just have less to distribute, which is a good thing!

But back to our example:

Let's say you've filled up the main categories "Essential, Variable and Self Improvement". ✅

For the sake of the example, let's stick to 300.000 HUF. So you have allocated a total of 300.000 HUF for these 3 main categories for this month.

This leaves you with 700.000 HUF out of 1.000.000. 🤔

Since your Safety Reserve is not yet funded and I assume you will earn money next month. So, I would put this 700.000 one on one in the Safety Reserve category. 🔒

Which means you are on track to reach 900,000 (your 3-month safety reserve). Because 700,000 / 900,000 is already there. 😉

Do you understand the logic? 🧠

The point is, as soon as you start, just spread your money out for the first month and put the rest in the safety reserve.

Then, as soon as the month is over and you get a new salary, take your salary, split the money into the main categories and put the rest back into the safety reserve. Until the 900,000 target is reached. 💪🏼

💡 Side note: Just our example of 900,000 is someone will have less, someone will have more, the point is to calculate your own.

Once the Safety Reserve is topped up and you are at 100%, you can do 2 things with the remaining money.

💰 Invest it (Which I will talk about in another post)

🏝️ We can put it on the Wish farm

And here comes the last step...

Step 7 - What on earth is a Wish farm? 🏝️

A Wish farm is a category of goals you have to achieve. So, things you collect, could it be a holiday, a new car, anything. 🏎️

You reward yourself with these by consciously managing your finances. 🎁

The point is, you can have up to 3 at a time:

🤏🏼 A small one - under 50.000 HUF

👍🏼 A small one - under 300.000 HUF

💪🏼 And one large - over 300.000 HUF

You can only put money in here if you have already filled your security reserve and you have extra money at the end of the month that you haven't spent. 🔒

side note I only have 1 thing on Wish farm which is "Travel" and that's what I save for every month.

But I used to save for my "Airpods" the same way. 🎧

Wish farm is good because you can actually reward yourself for keeping your promises to yourself and being smart with your finances. 🎉

Brilliant, that's it! 🤩

1 more thing left to show you how to write down you’re spending.

Here's a screenshot of it and I'll walk you through it below. 👇🏼

The 1st point is to choose whether we have just spent something or whether we have income. We can select this with the slider above. In this case we are recording an expenditure. 💸

Step 2 is to write down the exact amount, once again I'll write down the EXACT amount, if it's $1,001 then that's what you write. 📟

Step 3, to select from the subcategories what you spent it on. 🔍

Step 4, we choose how we paid, cash, private account, etc. So, where the app takes that amount from. 💳

Step 5, once everything is done, we save it and we are done! ✅

It takes about 15 seconds to record a spend and you can quickly turn it into a habit.

And voila! With this knowledge you are ahead of 98% of people. 🪄

When you manage your finances like this, you can call yourself financially savvy!

But if you want to be in the 1%, these books will help.

📕 Book recommendations: The Psychology of Money - Morgan Housel, Uncontrollable - Tony Robbins, Secrets of the Millionaire Mind - T Harv Ekker, The Intelligent Investor - Benjamin Graham and finally The Cashflow Quadrilateral - Robert Kiyosaki. Don't worry... if you don't want to read, you can find them all summarized in BookBase! 🎧

In the next section we will look at investment, because it is another important building block of this topic. 💰

I will also tell you what I invest my money in...

Since I know this part was quite a lot, I'll simplify it for you in the next one. 🤏🏼

✅ What exactly do you do?

[ ] First step, download the YNAB App. 📲

[ ] Step two, add up all your money and upload it to the system. 💰

[ ] Step three, make the main categories. 📝

[ ] Step four, do the subcategories. 📂

[ ] Step five, set a goal for the Safety Reserve. 🔒

[ ] Step six, divide your money into these subcategories and start topping up the Safety Reserve. 🔍

[ ] Step seven, as soon as you spend on something, immediately get out the App and write it down. Max. It takes 15 seconds. ✏️

[ ] Step eight, make it a habit and you'll have no trouble with your finances in life! 🔄

This was probably our most practical post so far.

Honestly, it may seem like a lot of work to incorporate at first, but trust me, it will pay off many times over! 😉

🔥 Biggest obstacle

Getting through my reading list quickly enough to make time for everything else. ⚡️

Specifically, there are 9 books right now that I want to read on Marketing and Copywriting. However, the 1 book a week fast pace has slowed down a bit because there are so many practical tips in them that I need to try them out. 📚

So now I'm looking for ways to speed this up.

One way was to listen to what was up on BookBase. 📕

The other was that, the ones I couldn't find in the App, I read the introduction of those and tried to put them in order based on that. 📖

That way, the ones I think are most useful will be at the front and the rest, which would only add small details to my knowledge, will be at the end. After all, they are important too, just not as much!

Then you can get ready, because the best ones will definitely be shortened to the BookBase so that YOU don't have that obstacle anymore! 📲

📖 What have I just read?

I finished "Copywriting Secrets" by Jim Edwards. It was quite a practical book with lots of tips and tricks, just the kind I like! 😎

So, I haven't stopped practicing for a moment and I've already written 1-2 copywriting texts in the new App, I'll be curious to see how you like it. 😅

Next will be "Scientific Advertising" by Claude Hopkins. A true classic from the then king of marketing. Written in 1923 and still relevant today. 🧠

I am curious to see what it will teach me and what new perspectives it will give me.

🎧 What have I just listened to?

I listened to the summary of "Scientific Advertising" at BookBase. Just to see if it's really worth reading in full format, but the answer is definitely yes! 🧪

And the "Your Next Five Moves" by Patrick Bet-David, 22 minutes, but pretty good insights in there! He outlines a methodology that can be applied at all levels of business. ♟️

✍🏼 Top quote

"What we don't measure, we can't change." ~ Peter Drucker